tax return rejected dependent ssn already used

I submitted a client return with their dependent daughter. Whether the cause of this rejection is the result of a typo on another.

10 Steps To Take If Your Tax Return Is Rejected

If your return was rejected due to your dependents SSN being used on another return the first thing to do is to verify that you entered the SSN correctly in the return.

. My tax return was rejected for dependent ssn was already used- this is my year to claim my dependent I believe my ex has claimed for this year when she is not eligible for this. Rejected due to SSN already used. I know I have not filed previously this year.

I also file the. Is this likely to result in a rejected return and a refund delay. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year.

Additionally if you think. You entered the wrong SSN on your tax return. SSN has been used on a previously accepted return.

Potential reasons why your SSN has already been used. Someone used my daughters Social Security number on a tax return. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year.

Whether intentionally or unintentionally someone else has claimed you as a dependent on a 2020 Federal 1040 tax return. A case of fat fingers digits transposed a small error can result in an. Yes your refund will be delayed.

If you did not file a Federal return at all this year contact the IRS immediately at 800-829-1040 as an income tax return has been filed using the Primary Taxpayers SSN. If someone uses your SSN to fraudulently file a tax return and claim a refund your tax return could get rejected because your SSN was already used to file a return. You will not be able to electronically file your.

Whether the cause of this rejection is the result of a typo on another. Return Rejected due to dependent social being used. My 1040 was rejected with code R0000-502-001.

Guide To Completing Irs Form 14039 Identity Theft Affidavit

What To Do When Your Tax Return Is Rejected Credit Karma

Irs Tax Notices Explained Landmark Tax Group

My Images For Just Lisa Now Intuit Accountants Community

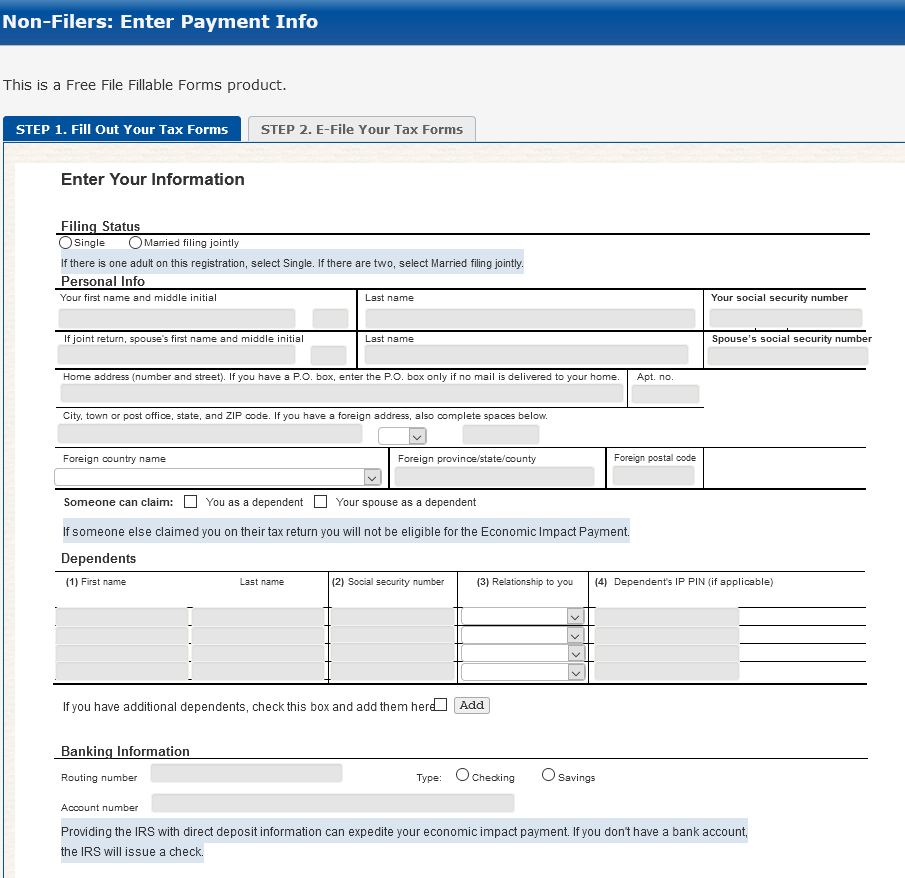

Non Filers Form Initially Rejected R Stimuluscheck

What Got Your Tax Return Rejected And What You Can Do About It

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

How To Fill Out The Irs Non Filer Form Get It Back

Rejected Tax Return Common Reasons And How To Fix

3 11 3 Individual Income Tax Returns Internal Revenue Service

Itin Rejection For Married Filing Separate Steps To Fix It

What To Do If Your Federal Return Is Rejected Due To A Duplicate Ssn

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Tax Return Rejection Codes By Irs And State Instructions

How To Fill Out The Irs Non Filer Form Get It Back

3 Ways To Write A Letter To The Irs Wikihow

3 11 3 Individual Income Tax Returns Internal Revenue Service

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)